Paycheck after taxes georgia

President Joe Bidens executive action to erase up to 20000 in student loan debt has caused some confusion over whether borrowers will have to pay state taxes on their. The Georgia tax code has six different income tax brackets based on the amount of taxable income.

Pin On Bellsouth Southern Bell Telephone Co

This includes tax withheld from.

. Well do the math for youall you need to do is enter. The Income Tax calculation for Georgia includes Standard deductions and Personal Income Tax Rates and Thresholds as detailed in the Georgia State Tax Tables in 2022 Federal Tax. If you make 70000 a year living in the region of Georgia USA you will be taxed 11993.

Skip to main content. For 2022 tax year. If you make 55000 a year living in the region of Georgia USA you will be taxed 11755.

Salary Paycheck Calculator Georgia Paycheck Calculator Use ADPs Georgia Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees. Payment with Return - Check or Money Order Form 525-TV Extension Payments Form IT-560 Estimated Tax Payment Form 500-ES Application to Request a Payment Plan. Your average tax rate is 1198 and your marginal tax rate is.

Married filers no dependent with an annual income of. Semi-weekly Monthly Quarterly or Annually. In Georgia payroll taxes are calculated after determining gross wages.

Use the Georgia salary calculator. Yes Georgia residents do pay personal income tax. The Georgia bonus tax percent calculator will tell you what your take-home pay will be for your bonus based on the supplemental percentage rate method of withholding.

You first have to calculate Federal income tax and Federal payroll tax using the aforementioned steps and then calculate. Taxable Income USD Tax Rate. 1500 after tax breaks down into 12500 monthly 2875 weekly 575 daily.

1500 after tax is 1500 NET salary annually based on 2021 tax year calculation. Calculate your take home pay after taxes. Georgia Income Tax Calculator 2021.

Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees in Georgia. A single Georgian with an annual wage of 56200 will earn 4417545 after federal and state income taxes. The tax brackets are different depending on your filing status.

Georgia Hourly Paycheck Calculator Change state Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and. The money also grows tax-free so that you only pay income tax when you withdraw it at which point it has hopefully grown substantially. Paying Georgia withholding tax Depending on the amount of tax withheld youll file and pay the tax either.

That means that your net pay will be 43245 per year or 3604 per month. Federal Georgia taxes FICA and state payroll tax. How to Calculate Salary After Tax in Georgia in 2022 The following steps allow you to calculate your salary after tax in Georgia after deducting Medicare Social Security Federal Income Tax.

Some deductions from your paycheck are made. Those that are filing as single see tax rates that range from 1 to 575. Withholding tax is the amount held from an employees wages and paid directly to the state by the employer.

Policy Basics Federal Payroll Taxes Center On Budget And Policy Priorities

The Independent Contractor S Guide To Taxes With Calculator Bench Accounting

Pay Your Taxes Funny Quotes Taxes Humor Funny Quotes Accounting Humor

The Top 9 Benefits Of 529 Plans Savingforcollege Com

Georgia Paycheck Calculator Smartasset

Pin On Bellsouth Southern Bell Telephone Co

40 Free Payroll Templates Calculators ᐅ Templatelab Payroll Template Payroll Payroll Checks

Payroll Tax Calculator For Employers Gusto

1973 Southern Bell Tel Co W 2 Form Telephone Identifying Numbers Coding

Form W 12 Example Seven Things You Most Likely Didn T Know About Form W 12 Example W4 Tax Form Tax Forms Tax

Pin By Joani S Whimsy On A Vision My Reality Payroll Template Doctors Note Lettering

Bank Of America Exiting Longstanding Brea Call Center In July Call Center Bank Of America Bank

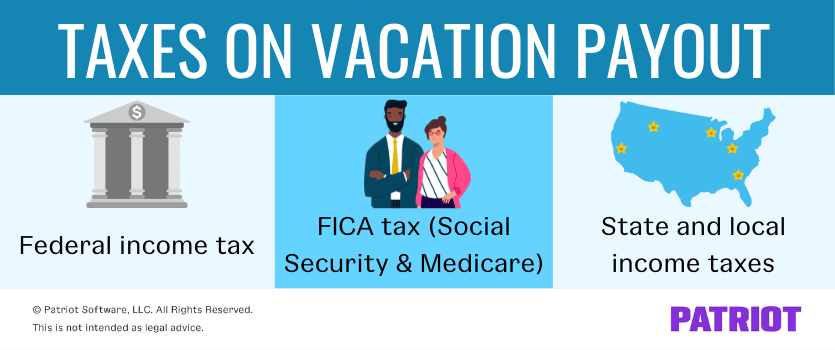

Taxes On Vacation Payout Tax Rates How To Calculate More

Pin On Bellsouth Southern Bell Telephone Co

80 000 Income Tax Calculator New York Salary After Taxes Income Tax Payroll Taxes Salary

Paycheck Tax Withholding Calculator For W 4 Tax Planning

Georgia Paycheck Calculator Smartasset